Many people are astonished to discover that there are a selection of real estate loan programs backed by new FHA. Some of the most popular single-family members FHA insured financial programs are:

Earliest FHA mortgage financing 203(b)

The loan is intended to possess a debtor who want to pick or refinance a first residence. A keen FHA 203(b) financial is funded because of the a lender for example a good bank or borrowing from the bank union and you may insured from the HUD.

- See practical FHA credit certificates.

- Approximately 96.5% of the price could be financed, and initial home loan insurance premium.

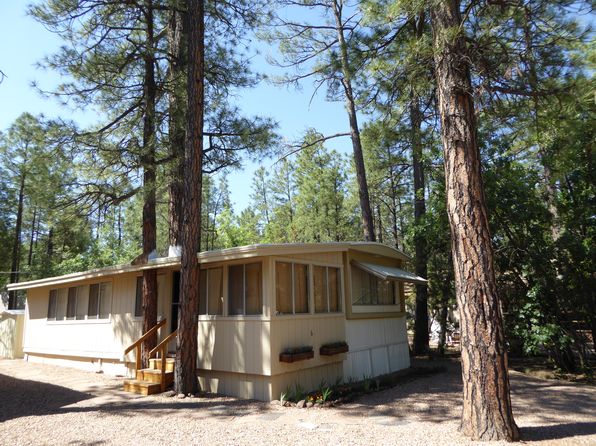

- Eligible attributes is step 1-4 equipment structures.

Changeable rates FHA mortgages

An adjustable rate mortgage (ARM) has an interest price you to definitely occasionally alter across the title from the borrowed funds. The original interest off an arm is usually less than a predetermined speed mortgage, and come up with a variable speed FHA financial a possibly good choice proceed the link now to own individuals whom intend on carrying your house to possess a short span of your energy before promoting or refinancing.

- 1- and step 3-year Hands that will boost by step one% following beginning repaired rate of interest several months and also by 5% across the lifetime of the loan.

- 5-year Sleeve with an interest rate that can improve from the step 1% annually and you can 5% along the longevity of the mortgage, otherwise by the 2% annually and you may six% along the longevity of the mortgage.

- 7- and ten-seasons Arms might only increase because of the 2% annually after the birth fixed interest rate months by 6% along side lifetime of the mortgage.

Energy efficient FHA mortgage loans (EEM)

Energy efficient mortgages (EEMs) supported by the fresh new FHA are designed to help a borrower finance energy-efficient developments and you will renewable energy systems. Advancements fashioned with a keen EEM help make house working will set you back lower and build a whole lot more possible income.

So you can qualify for an enthusiastic EEM, a debtor must get a property energy comparison to understand times successful possibilities and the pricing-effectiveness of improvements.

Rehab FHA mortgage 203(k)

The brand new 203(k) rehab program allows a debtor to invest in the acquisition and cost of rehabilitating a home having fun with one mortgage, or even fund the brand new treatment regarding a preexisting household.

Short-identity funds instance a good HELOC or hard-currency financing normally have large rates. not, a good 203(k) is a single, long-label fixed or variable interest rate financing accustomed fund one another the purchase and you may upgrade regarding property.

- Architectural changes such adding extra square footage so you’re able to a house.

- Removing safety and health problems, which happen to be possibly located when a past owner is unable to take care of property.

- Reconditioning or replacement technical options including plumbing system and you will electronic so you’re able to satisfy local strengthening codes.

Term I renovations FHA financial

A name I do-it-yourself mortgage is actually covered from the HUD and you can issued of the a personal bank, particularly a lender from credit relationship. Developments need certainly to significantly manage or improve the livability otherwise electricity off the house, and you may a concept We loan may be used in conjunction with an effective 203(k) treatment mortgage.

To help you qualify for a title We home improvement loan, a house have to be occupied for around 90 days earlier in the day in order to applying for the loan. Interest rates is actually repaired according to research by the most common ounts more than $eight,five-hundred have to be covered by a home loan into the action regarding faith on property.

One of the primary benefits to using a keen FHA loan for an investment property was the lowest down-payment regarding step 3.5%. However, the new tradeoff in making a little down payment is having to shell out an initial mortgage advanced (MIP) together with month-to-month financial insurance coverage over the longevity of the mortgage.